A recent report by the Federal Trade Commission’s Consumer Sentinel Network offers eye-opening insights into the state of financial fraud in the United States. Key among the findings, reported fraud losses rose to $10 billion in 2023, up from $9 billion in 2022.

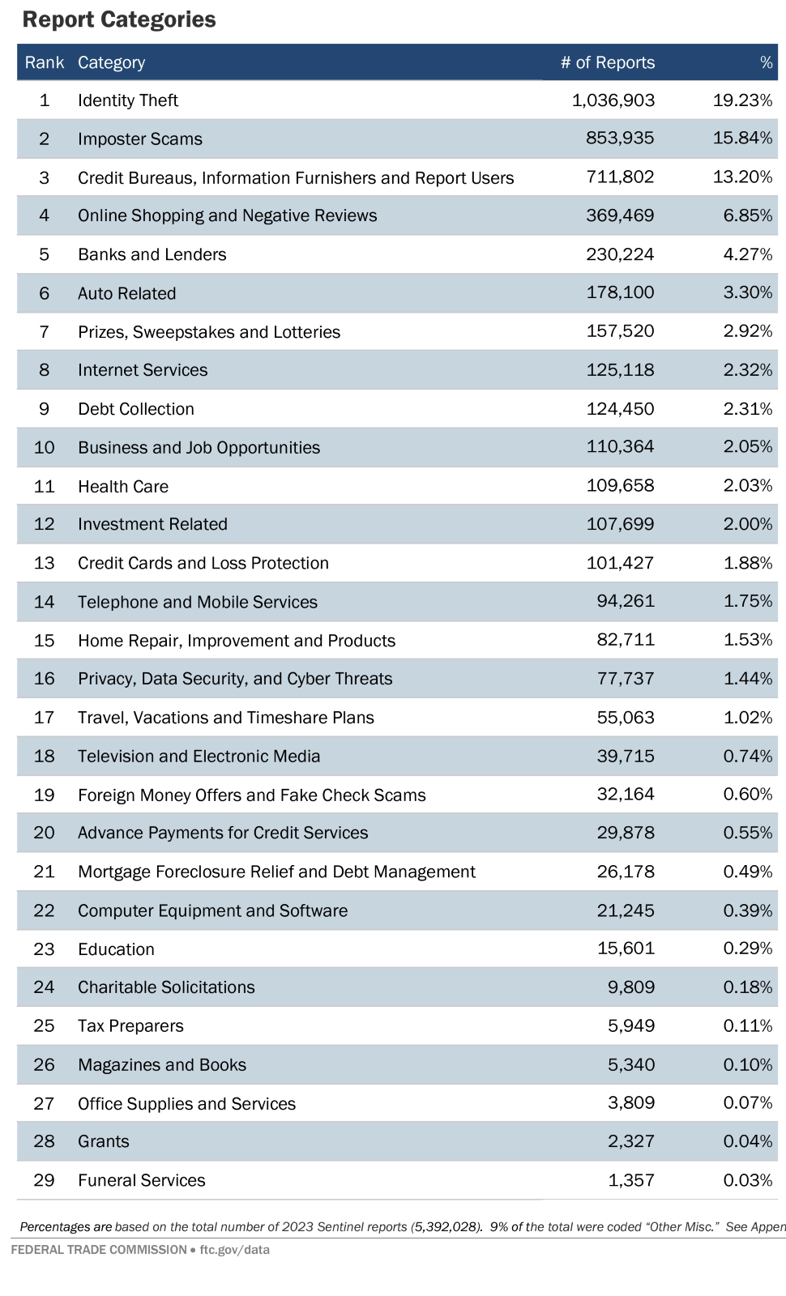

Fraud Categories

This year’s publication analyzed over 5.39 million consumer reports, with fraud accounting for 2.6 million, or 48 percent of reports, followed by Identity theft at 1.0 million, or 19 percent, and other forms of fraud rounding out the rankings.

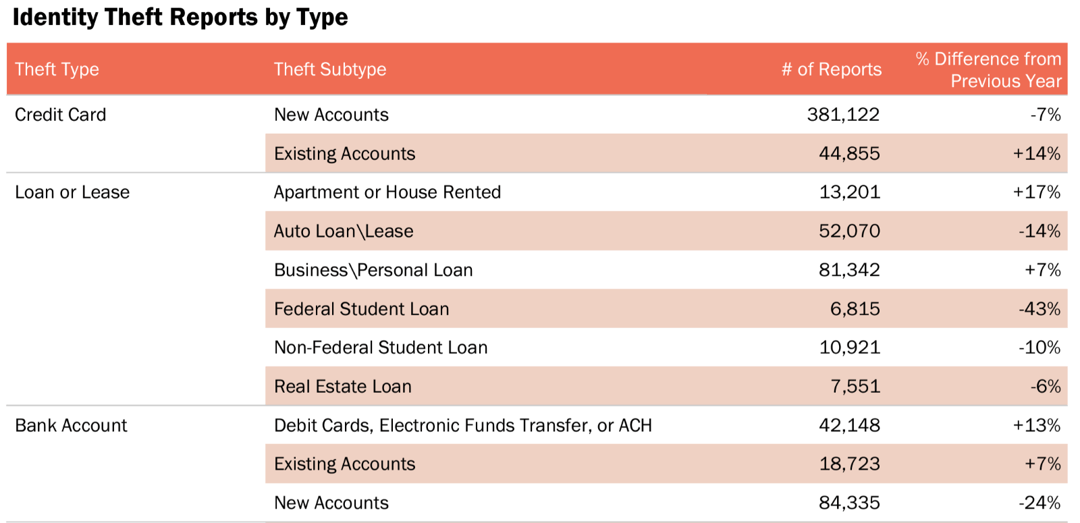

Identity Theft Types

Credit Card tops the list of identity theft types reported in 2023. The FTC received over 416,000 reports from people who said their information was misused with an existing credit card, representing an increase of 14 per cent over 2022 or when applying for a new one, which decreased seven per cent year-over-year.

Loan or lease scams were the second most reported type of theft, followed by bank accounts, in which debit cards, Electronic Funds Transfer, or ACH, rose 14 percent to more than 42,000.

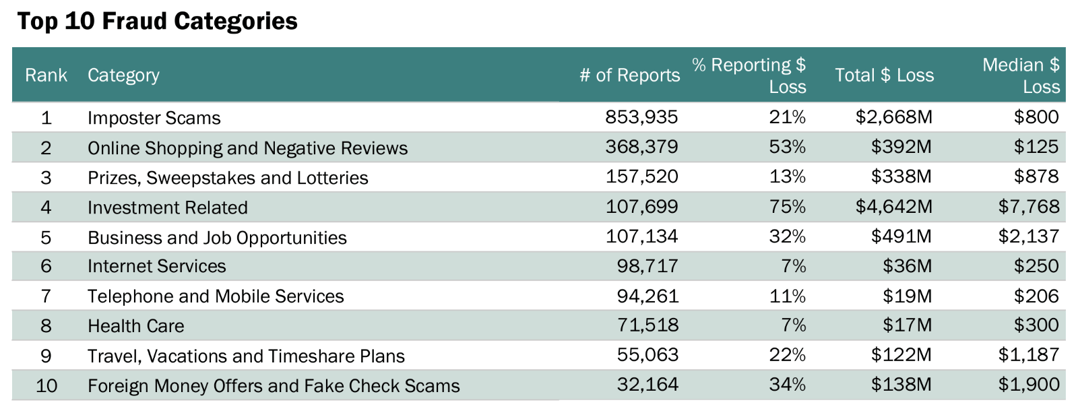

Imposter Scams

Among methods for securing the information required to perpetrate financial fraud, imposter scams in which criminals claim to be a romantic interest, the government, a relative, a business, or a technical support agent accounted for over 850,000 cases or nearly 16 per cent of reports. Among those, email was the most popular method of contact.

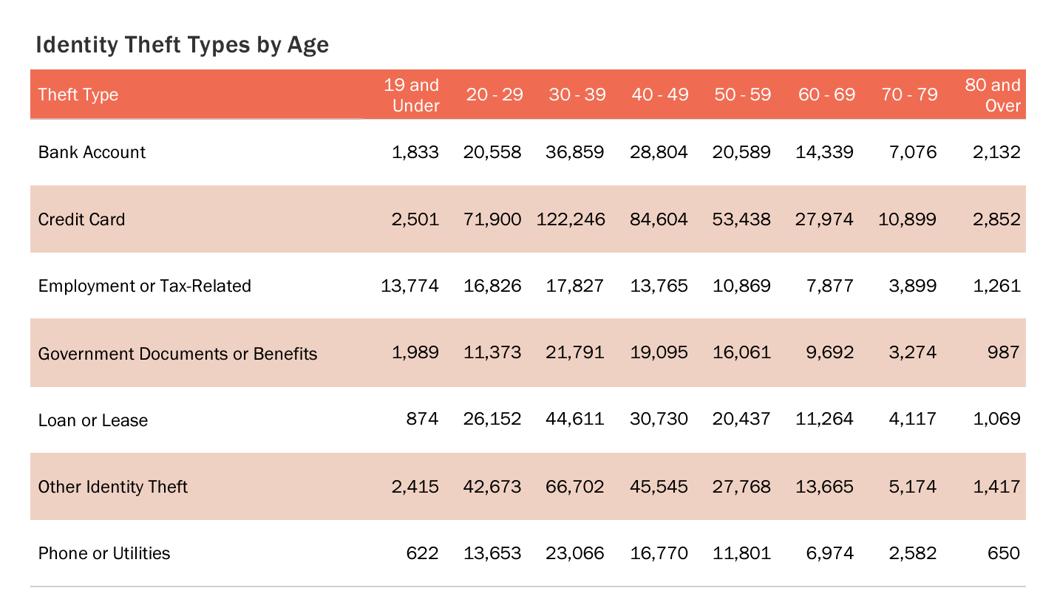

Age of Victims

Those aged 20-29 reported losing money to fraud in 44% of cases, people aged 70-79 reported losing money in 25 per cent, and people 80 and over reported it in 22% of their reports. But when they did experience a loss, people aged 70 and older reported much higher losses than other age groups.

Geography

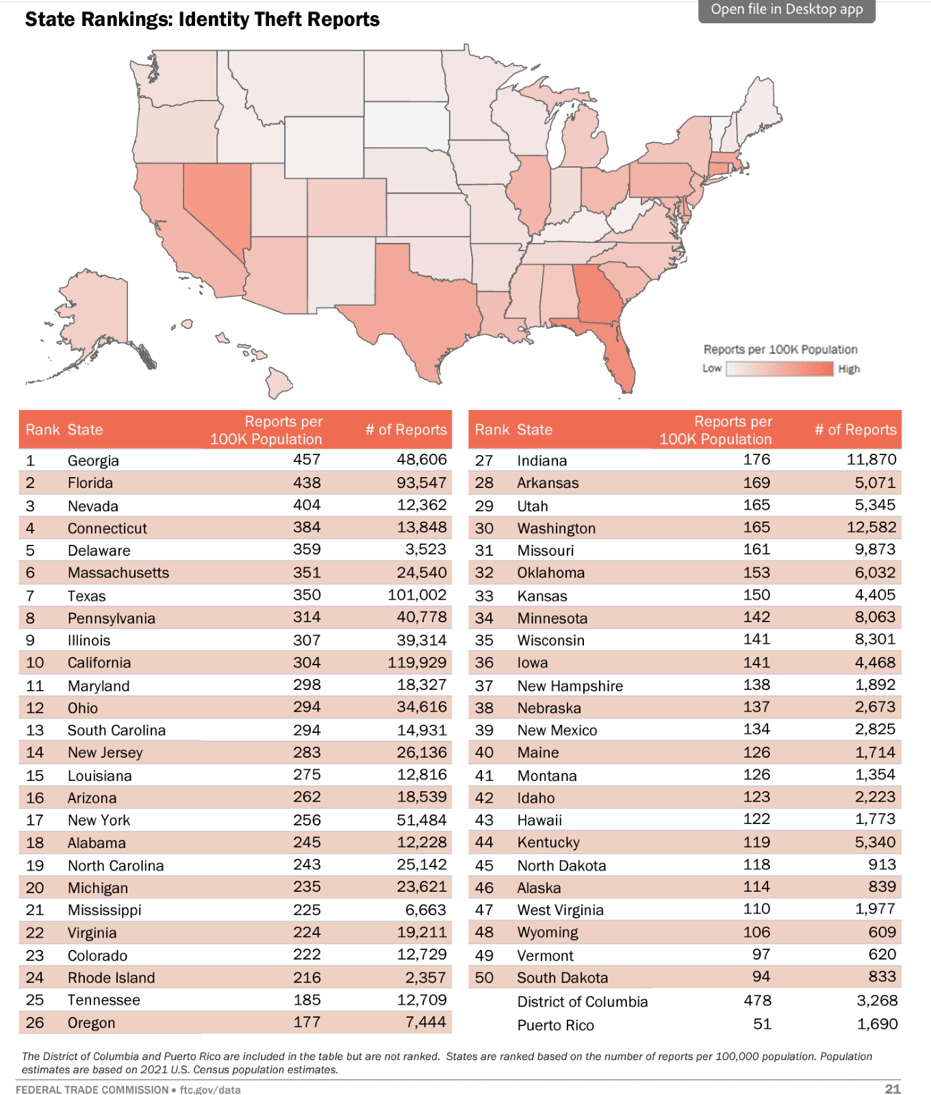

Top States The states with the highest per capita rates of reported fraud in 2023 were Georgia, Florida, Nevada, Delaware, and Maryland. For reported identity theft, the top states in 2023 were Georgia, Florida, Nevada, Connecticut, and Delaware.

About the Consumer Sentinel Network Data Book

Since 1997, the Consumer Sentinel Network has collected millions of consumer reports about fraud, identity theft, and other consumer protection topics directly and through reports filed with federal, state, local, and international law enforcement agencies as well as organizations like the Better Business Bureau.

The report data is stored in a secure online database to aid law enforcement in spotting trends, identifying questionable business practices, and enforcing consumer protection laws. While the database itself is accessible only to law enforcement, the FTC releases aggregate data to the general public annually.